Operating a business? How do your terms of trade look?

Companies that provide goods or services on standard terms (including credit terms) should be regularly having a legal health check of their terms and their practices for ensuring the terms they are using accurately reflect their business practices, meet all of their requirements and cover off their key risks – as well as ensuring they are appropriately brought to the attention of customers or clients so that they are valid, enforceable or binding.

Terms of trade (which may be called "terms of engagement" or "standard terms of contract") will often contain virtually all of your key legal rights and remedies in respect of the customers that you supply and if drafted appropriately, can greatly assist in managing disputes in a cost-effective and beneficial way, allow ready enforcement of your legal rights, and ensure that you are complying with the law in respect of the information you obtain about your customers and the way that you conduct business.

Importantly, your terms of trade will contain and protect a supplier's main right – the right to be paid for the goods and/or services that the supplier provides – and often how that payment will be calculated.

In a legal sense, terms of trade are absolutely essential to your business.

Key terms to include

Terms of trade will differ depending on whether your business supplies products or services.

There are some keys terms that are relevant in both scenarios though:

Price – how is the price for the products or services calculated? For example, quote, price list, or hourly rate.

- Payment – when is payment due? If you need to pursue a customer for failing to pay it is also important your terms include the right to charge default interest and require the customer to pay your debt recovery costs.

- Liability – your liability exposure will vary depending on whether your customers are consumers or businesses. If you sell products or services to consumers, then you will need to comply with the Consumer Guarantees Act 1993. If you are selling to businesses instead, it is common to limit and exclude your liability as much as possible. For example, a business will often exclude their liability for losses suffered by a customer resulting from defective products or services that the business couldn’t reasonably foresee.

- Termination – if your terms of trade are to apply to multiple future transactions between you and the customer, you should include termination rights allowing you or the customer to end the relationship. You may wish to terminate on giving a period of notice, or where a party is not complying with their obligations.

- Guarantee – if you are supplying products or services to a company and you have concerns about payment, you could consider requiring the directors to guarantee the company’s obligations. To be enforceable though, the guarantee must be signed by the guarantors.

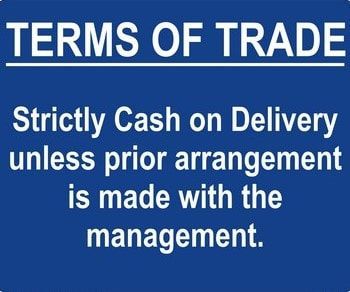

Terms need to be agreed

Once you have terms of trade, they also need to be brought to the attention of the other party and you need to be sure you have clear evidence that they have agreed to them. If you cannot evidence this agreement, your terms may not form part of your contract and you may not be able to enforce them. Arguments over whether terms have been agreed or not can be costly. We assist to ensure that your business practices clearly evidence that your customers have agreed with your terms. Depending on the business relationship and context, this can be as simple as:

- having a customer sign an account or credit application form including the terms;

- sending the terms by email and getting confirmation they are accepted and retaining those emails; or

- having a person tick a tick box on your website, confirming that they have read and agreed to your terms before providing them a gateway to complete further business.

Changes to the Law

There are lots of statutes that impact on your terms of trade and your business – as well as impact on certain rights you may wish to enforce.

Even if you have good terms of trade, you should be having regular updates to make sure that a recent legal change has not had an undesired impact on your terms. You can also take advantage of changes to legislation that might benefit you.

Failure to have Terms of Trade can be costly!

Terms of Trade can have good enforcement provisions that assist you to get paid quickly and maximise your cash flow. If you cannot enforce the terms you want with customers, you can lose a lot of money, both in arguments with customers or through being unable to enforce the terms you need.

The only way to avoid this is to have well drafted, up-to-date terms of trade that comply with the law, reflect your business practices and requirements and manage your risks – and are able to be demonstrated as being agreed by the customer and therefore binding. Being in a position to use standardised terms of trade means that you do not need to enter different contracts with each customer, so there is already a cost saving that one size will fit all. We recommend that cost saving is used by making sure you get appropriate legal support to ensure your standard terms are the best that they can be.

We think the points we have made are pretty conclusive that ensuring that you have good terms of trade is something that warrants legal expenditure; it is a cost that will more than pay for itself in terms of good business and risk management. We are happy to help.

Key terms to include

- Price – how is the price for the products or services calculated? For example, quote, price list, or hourly rate.

- Payment – when is payment due? If you need to pursue a customer for failing to pay it is also important your terms include the right to charge default interest and require the customer to pay your debt recovery costs.

- Liability – your liability exposure will vary depending on whether your customers are consumers or businesses. If you sell products or services to consumers, then you will need to comply with the Consumer Guarantees Act 1993. If you are selling to businesses instead, it is common to limit and exclude your liability as much as possible. For example, a business will often exclude their liability for losses suffered by a customer resulting from defective products or services that the business couldn’t reasonably foresee.

- Termination – if your terms of trade are to apply to multiple future transactions between you and the customer, you should include termination rights allowing you or the customer to end the relationship. You may wish to terminate on giving a period of notice, or where a party is not complying with their obligations.

- Guarantee – if you are supplying products or services to a company and you have concerns about payment, you could consider requiring the directors to guarantee the company’s obligations. To be enforceable though, the guarantee must be signed by the guarantors.

Terms need to be agreed

- having a customer sign an account or credit application form including the terms;

- sending the terms by email and getting confirmation they are accepted and retaining those emails; or

- having a person tick a tick box on your website, confirming that they have read and agreed to your terms before providing them a gateway to complete further business.

Changes to the Law

Failure to have Terms of Trade can be costly!